IPF is glad to present you its ESG Policy, which provides guidance on the processes involved in developing an ESG framework.

IPF promotes an ESG considerate culture and behaviour, enabling it to take into account the full spectrum of ESG issues impacting its business (both strategically and operationally).

IPF Fund II (since 28 February 2023) and IPF Fund III are Art. 9 funds as per SFDR.

1. PURPOSE

The ESG principles refer to an investment approach, which explicitly acknowledges the relevance of ESG factors in investment decision-making, as well as in the generation of long-term sustainable returns.

The purpose of this policy is to define the IPF approach to integrating ESG considerations.

IPF will seek to update this policy on a continuing basis, as deemed appropriate.

2. INTEGRATION OF RESPONSIBLE INVESTMENT PRINCIPLES

A responsible investment approach integrates ESG factors into investment decisions, to identify risks, generate sustainable, long-term returns and align with investors’ values. It focuses not only on financial performance but also on the broader impact of investments on society and the environment.

The Policy not only states how IPF integrates ESG considerations at a company level but also serves as our responsible investment policy. It outlines IPF approach to integrating these principles specifically within our investment processes, with a particular focus on the social aspect of ESG.

Our commitment to the social dimension is reflected in our investment strategy, where we contribute to positive social outcomes by solely investing in companies that have a direct or indirect positive impact in the healthcare sector.

3. LEGAL FRAMEWORK

Regulation (EU) 2019/2088 of The European Parliament and of the Council of 27 November 2019 (the Disclosure Regulation) on sustainability‐related disclosures in the financial services sector.

4. DEFINITIONS

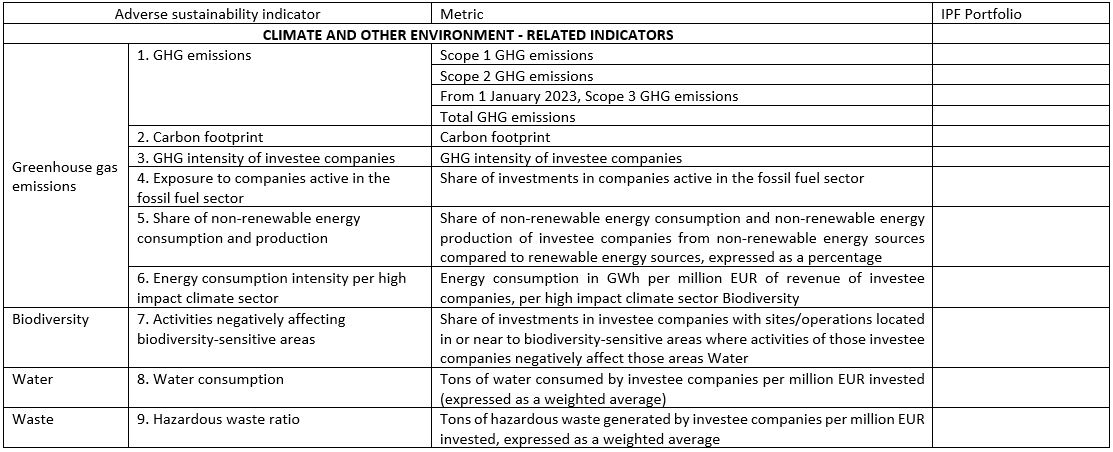

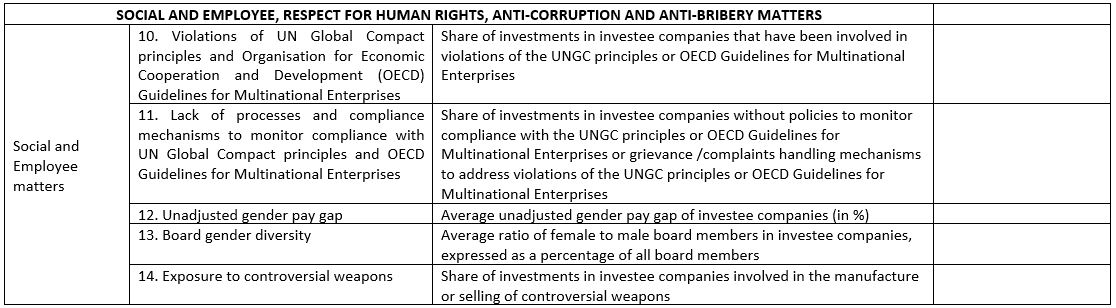

Principal Adverse Impact (PAI) means any negative impacts that investment decisions or advice could have on Sustainable Investment objective.

Sustainable Investment means an investment in an economic activity that positively contributes to an environmental or social objective, provided that the investment does not significantly harm any environmental or social objective and that the investee companies follow good governance practices.

Sustainability Risks refer to environmental, social and/or governance events or conditions, such as climate change, which, if they occur, could cause a material negative impact on the value of an investment.

The Disclosure Regulation currently specifies three distinct categories for investment products with regards to sustainable investing and ESG considerations:

- Article 6 financial products either integrate ESG considerations into the investment decision making process or explain why sustainability risk is not relevant, but do not meet the additional criteria of Article 8 or Article 9 strategies.

- Article 8 financial products promote environmental and/or social characteristics, and may invest in sustainable investments, but do not have sustainable investing as a core objective.

- Article 9 financial products have sustainable investment as their core objective

5. THE ESG FACTORS

Environmental, Social and Governance are the three key factors used to evaluate a company’s sustainability.

Below are the definitions of what is included under Environmental (E), Social (S) and Governance (G) aspects and examples of the main ESG factors.

- Environmental: i.e. factors relating to the quality and functioning of the natural environment and natural systems

- air and water pollution,

- climate change,

- deforestation,

- energy efficiency,

- access to raw materials (e.g. commitment to preserving the natural environment),

- product evolution (e.g. low energy products, … ),

- waste management,

- water scarcity,

- regulation (e.g. laws on environmental pollution, governance codes).

- Social: i.e. factors relating to the rights, well-being and interests of people and communities. In the healthcare sector, the S factor of ESG is profoundly material, extending beyond general employee and community relations to encompass the core mission of patient care, health equity, and public well-being. Healthcare organizations have a unique and central role in society, making their social impact a critical component of their overall sustainability and long-term value

- quality and safety of care,

- equitable access to healthcare,

- product safety and quality,

- clinical trial diversity,

- employee well-being and safety,

- diversity, equity and inclusion,

- talent development and retention

- labour practices,

- equality of treatment across all staff irrespective of role, gender, race, age, religious belief or sexual orientation,

- data protection and privacy.

- Governance: i.e. factors relating to the governance of companies, partnerships, networks and other investee entities

- board structure, size, diversity, skills and independence,

- executive remuneration,

- shareholder rights (e.g. election of directors, capital amendments),

- stakeholder interaction,

- disclosure of information including accounting standards,

- business ethics in all business conduct (e.g. anti-money laundering, anti-corruption, reputational due diligence, anti-competitive behaviour, bribery and corruption),

- internal controls and risk management, and, in general, issues dealing with the relationship between a company’s management, its board, its shareholders and its other stakeholders,

- matters of business strategy, encompassing both the implications of business strategy for environmental and social issues, and how the strategy is to be implemented,

- compliance with international standards of remuneration and bonus policies.

The key ESG factor used by IPF is the Social one, specifically on life science and health companies (which by essence have social impact).

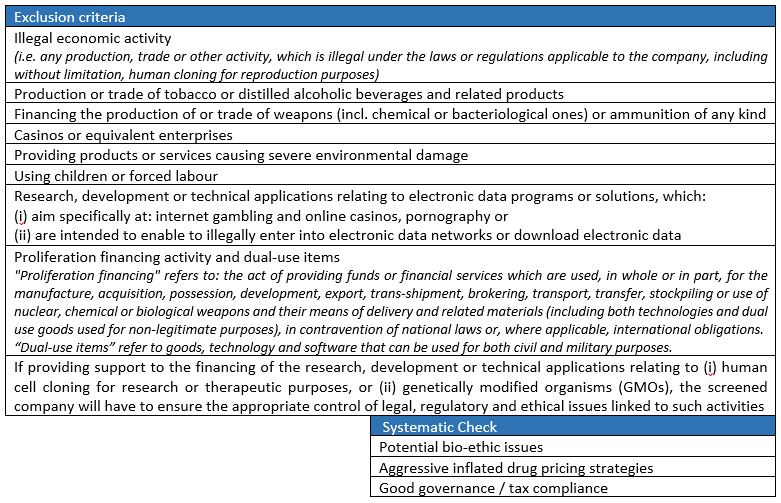

The Policy does not focus on Environmental factors except for digital companies and manufacturers, which may have significant environmental footprints. Given IPF investment focus on SMEs in Life Science and Health, especially biotechs and digital health companies, such considerations are not material or measurable within IPF portfolio companies. However, the IPF exclusion criteria already take the environment into account by avoiding investments with significant negative environmental impact. The IPF ESG approach emphasizes social impact contribution, where IPF portfolio companies are most relevant and impactful.

6. INTEGRATION OF THE DISCLOSURE REGULATION INTO IPF FUNDS’ INVESTMENTS

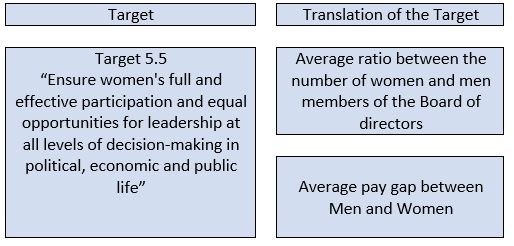

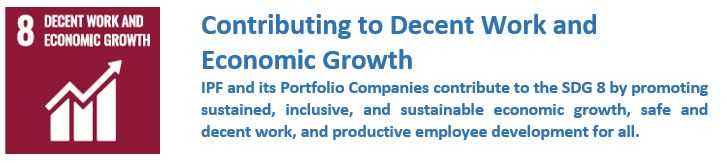

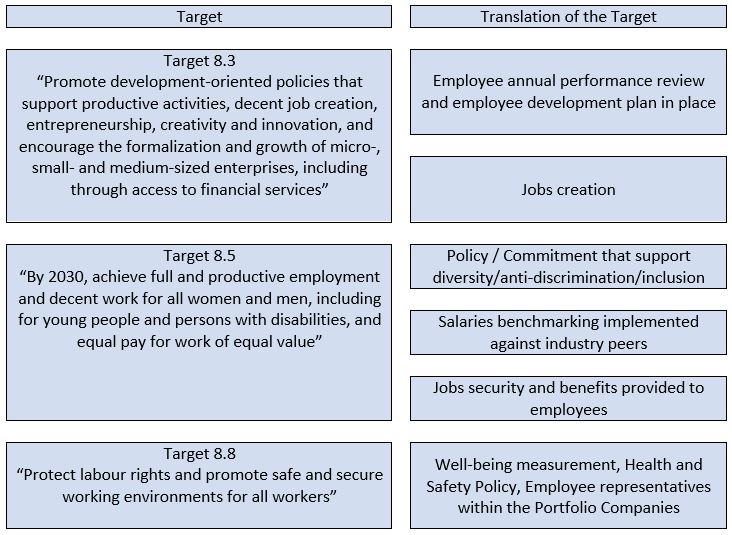

Though its investments have Social impact, IPF has identified other ESG factors (as relevant targets) which align with the United-Nations Sustainable Development Goals (the SDGs) and that are the most relevant for our sector and where IPF is concentrating its efforts.